What Is Ethena Protocol?

The Ethena Protocol is aiming to transform the DeFi space with its USDe synthetic token. This guide will dive into what the Ethena Protocol is all about, what it brings to the table, and the advanced technologies introduced by Ethena Labs, the team behind the protocol.

Ethena is a synthetic currency protocol developed on the Ethereum platform, offering a cryptocurrency investment alternative that operates independently of traditional banking systems. Its goal is to provide crypto investors with a blockchain-based, dollar-denominated savings option, termed the “Internet Bond”.

The protocol's key synthetic asset, USDe, is designed to maintain a 1-to-1 peg the US dollar by staking Ethereum for a specified duration.

The "Internet Bond" aims to utilize returns from staked Ethereum and profits from perpetual and futures market settlements to establish an on-chain crypto 'bond.' This instrument serves as a dollar-denominated savings tool for users in permissible jurisdictions, similar to U.S. Treasury bonds in the traditional finance sector. It provides essential collateral for DeFi, offering an uncensorable, yield-generating asset and a currency for transactions on centralized exchanges.

Ethena Labs successfully raised $14 million in funding for its synthetic dollar project, as announced on February 16, with support from Dragonfly and other notable venture capitals. An earlier funding round in 2023 saw a $6 million investment from leading firms including Binance Labs Gemini, Bybit, Mirana Ventures, OKX Ventures and Deribit.

How Does Ethena Protocol Work?

USDe is a key component of the Ethena Protocol. Its 1/1 peg to the US Dollar is fully backed by ETH, which is staked by a user as collateral. However, ETH like any other cryptocurrency is subject to volatility. So sudden fall in ETH's price poses a risk to USDe, similar to what happened with UST in the Luna ecosystem.

Relying solely on ETH for collateral is insufficient, therefore Ethena Labs implements delta hedging. This strategy involves taking short positions in ETH or ETH-related derivatives, which compensate for the loss in ETH's value, thus maintaining USDe's peg.

By opening a 1:1 short position against the ETH collateral without leveraging, Ethena enhances its protocol's reliability. The goal of delta hedging is to achieve delta-neutrality, keeping the firm's portfolio value stable despite minor changes in ETH price.

USDe can also act as collateral or be native assets in other DeFi applications or staked on Ethena for additional rewards.

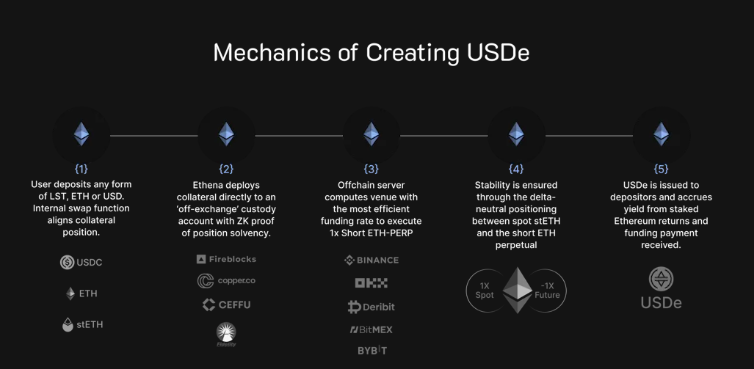

Here's how it works in practice:

A user deposits approximately $100 in stETH (staked ETH) and instantly receives about 100 USDe, minus any fees for executing the hedge.

Minting and redeeming USDe include slippage and execution fees in their pricing, with Ethena Labs not profiting from these user transactions.

Correspondingly, Ethena Labs initiates a short perpetual position of similar dollar value on a derivatives exchange.

Received assets are then handled by an "Off Exchange Settlement" provider, keeping backing assets both on-chain and off-exchange to lower counterparty risks.

In return, the protocol shares the rewards from hedging and staking Ethereum with users, rewarding them with USDe proportional to the amount of Ethereum contributed, with a variable APY.

Although Ethena Labs facilitates the management of backing assets for short perpetual hedging positions on derivatives exchanges, it never relinquishes custody of these assets.

Source & Copyright: Ethena Blog

ENA Token

Recently, Ethena introduced its own native token, $ENA. The main purpose of this Ethena token is to allow holders to participate in governance votes concerning the protocol. This covers decisions on risk management, DEX partnerships, USDe collateral exposure, and more.

Ethena made its debut as the 50th project on Binance Launchpool on March 29, with intentions to list the ENA token on April 2, across different trading pairs. Bybit Launchpool also welcomed ENA for its introduction and future listing.

Ethena Labs announced on March 28th a significant airdrop of 750 million ENA tokens to shard holders—digital units representing user engagement with the protocol. This airdrop accounts for 5% of the total 15 billion ENA supply.

Following the airdrop, Ethena is planning to initiate a campaign that brings in fresh incentives for the next airdrop phase.

This follows the Ethena Shard Campaign, a six-week initiative encouraging users to earn “shards” through protocol activities, during which USDe's supply reached $1.3 billion.

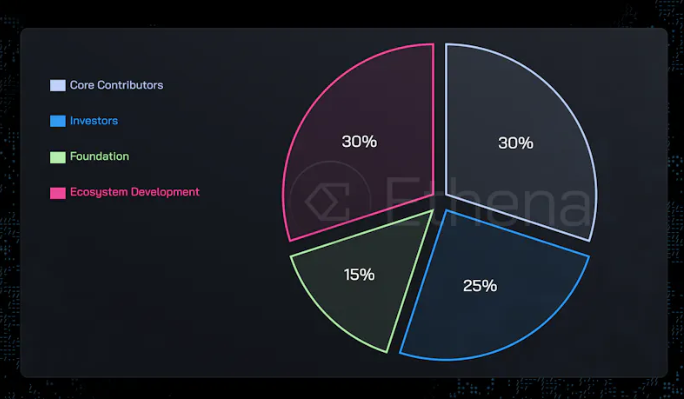

Token Distribution:

- 30% is allocated to core contributors

- 25% goes to investors

- The Foundation gets 15%

- 30% is set aside for ecosystem development

Source & Copyright: Ethena Blog

Final Words

Considering the market capitalization of Ethena, along with the attractive annual yields they provide, and the significant total value locked at $1.6 billion, the project appears quite promising when also taking into account their growing user base and investor interest. Nonetheless, we always encourage you to conduct your own research (DYOR) on any investment. We will continue to monitor Ethena and provide updates as they become available.