What is DYOR and Other Key Rules in Crypto?

Explore the importance of DYOR in our -depth guide. We will take you through the process of conducting your own research, understanding the crypto market, and following key investment rules.

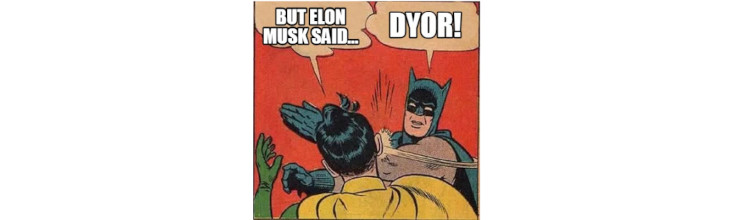

You've probably heard the phrase "DYOR" more times than Bitcoin has been on a rollercoaster ride if you've been exploring the world of cryptocurrencies. DYOR stands for "Do Your Own Research" and it is a golden rule for anyone venturing into the crypto space.

Now, you might be thinking, "Research? I thought crypto was all about making quick cash!" Well, that's a common misconception. Sure, some folks have made a fortune overnight, but those are the exceptions, not the rule. The crypto world is a complex beast, filled with jargon, technology, and volatility.

That's where DYOR comes in. It's about taking the time to understand what you're getting into, to make informed decisions rather than jumping on the bandwagon.

In this article, we'll guide you through the key rules of crypto, from DYOR to HODLing, and everything in between.

What is DYOR?

DYOR can be regarded as a call to action, a reminder that in the crypto universe, knowledge is power and ignorance can be costly.

At its core, DYOR is taking ownership of your investment decisions. It's about not blindly following the crowd or getting swept up in the hype, but making informed decisions based on thorough, unbiased research.

Think of it this way: If you were planning a road trip, you wouldn't just jump in the car and start driving, would you? No, you'd plan your route, check the weather, and maybe even do a little research on the best places to eat along the way. That's DYOR in a nutshell.

In the context of crypto investing, DYOR involves a deep dive into a potential investment as well as staying informed about the broader crypto market and the global economic landscape. It's about understanding how different factors, like regulatory developments or macroeconomic trends, could impact your investment.

In essence, DYOR is arming yourself with knowledge. Because in this industry, knowledge isn't just power, it's your best line of defense against the risks that come with investing in crypto.

How To DYOR in Crypto?

Now that we know what DYOR is, let's talk about how to actually do it. Here are some steps to guide you:

Understand the Basics

This is where your crypto journey begins. Understanding the fundamental concepts of blockchain technology and cryptocurrencies is extremely important. Start with the basics like what blockchain is, how it works, and why it's considered ground breaking. Then move on to understanding cryptocurrencies, their purpose, and how they function. Learn about Bitcoin, the pioneer of cryptocurrencies, and then explore others like Ethereum, which introduced smart contracts. There are plenty of resources available online, from articles and blogs to YouTube videos and online courses. This step might take some time, but it's worth it. Remember, a strong foundation will help you make informed decisions in the future.

Research the Project

Once you're comfortable with the basics, it's time to focus on the specific cryptocurrency or project you're interested in. Here's what you should look for:

What problem is the project trying to solve? Is it something that needs a blockchain solution? Does the project have a clear use case? A project with a clear and meaningful purpose is more likely to succeed.

A project's whitepaper is like its blueprint. It should detail the project's purpose, the problem it's solving, how it plans to solve it, the technology it's using, the team behind it, and its roadmap for the future. A well-written, comprehensive whitepaper is a good sign.

Who's behind the project? Does the team have experience in blockchain technology or in the industry they're targeting? A strong, experienced team can significantly increase a project's chances of success.

Does the project have a clear roadmap? A good roadmap gives you an idea of the project's future plans and when they aim to achieve them.

Check the Community

The community surrounding a project can give you valuable insights. Look for an active, engaged community. Check the project's social media channels, Reddit threads, and Telegram groups. Are the team members active in the community? Do they regularly update their progress? A strong community can be a powerful force in driving a project's success.

Evaluate the Tokenomics

Tokenomics involves understanding the supply and demand characteristics of a cryptocurrency. Here's what to consider:

Supply: Is the supply capped or unlimited? A capped supply can lead to increased demand over time, which can drive up the price.

Distribution: How are the tokens being distributed? Are they being fairly distributed, or do a small number of people hold a large percentage of the supply?

Use Case: Does the token have a use case, or is it just a speculative asset? A token with a use case is generally a safer bet.

Check the Market

Look at the current market conditions. Is it a bull market (prices are rising) or a bear market (prices are falling)? Market conditions can significantly impact a cryptocurrency's price.

Historical Performance

While past performance is not an indicator of future results, it can give you an idea of how the cryptocurrency has reacted to different market conditions.

Risk Assessment

Finally, assess your risk tolerance. Investing in a new, unproven project could potentially bring high returns, but it also comes with high risk.

DYOR is not a one-time thing. It's an ongoing process. The crypto market is highly dynamic, and things can change rapidly. So, keep researching, keep learning, and stay informed.

Why Is It Important To Do Your Own Research?

Doing your own research is critical because, in the world of crypto, the stakes are high. The potential for gains is enormous, but so is the potential for losses. And unlike traditional investments, crypto is largely unregulated, which means there's a lot of room for scams and shady practices.

By doing your own research, you'll be able to invest with confidence, knowing that you've made the best decision based on the information available to you. And if things go south, you'll know that it was a risk you understood and were willing to take, rather than a blind leap of faith.

Some Other Key Rules in Crypto

Here are a few other golden rules for crypto investors to keep in mind:

Never Invest More Than You Can Afford to Lose

This golden rule of investing is particularly relevant in the crypto space. Cryptocurrencies are known for their volatility. Prices can skyrocket, but they can also plummet. Therefore, it's important to only invest money that you can afford to lose. This doesn't mean expecting to lose money, but rather not putting yourself in a financially vulnerable position if the market takes a downturn.

Diversify Your Portfolio

Just as you wouldn't put all your eggs in one basket, you shouldn't put all your money in one cryptocurrency. Diversification is a risk management strategy that involves spreading your investments across various assets to reduce exposure to any one particular asset. In the context of crypto, this could mean investing in different types of cryptocurrencies, such as Bitcoin, Ethereum, and others. It could also mean diversifying across different sectors within the crypto space, such as DeFi, NFTs, and more.

Keep Your Crypto Secure

Cryptocurrencies are stored in digital wallets, and these wallets are secured with private keys, a kind of digital password. Make sure to keep these private keys safe and secure. If they fall into the wrong hands, your assets could be stolen, and because of the nature of blockchain, it's almost impossible to get them back. Use hardware wallets for storing your crypto, enable two-factor authentication, and never share your private keys with anyone.

Stay Calm and HODL

HODL is a term that originated in the crypto community and stands for "Hold On for Dear Life". It refers to the strategy of holding onto a cryptocurrency rather than selling it, even when the market is volatile. The idea is that while the value of a cryptocurrency may decrease in the short term, it will increase in the long term. So, when the market is down, stay calm and HODL.

Stay Informed

The crypto market is dynamic and can change rapidly. New projects are launched, regulations are introduced, and technological advancements are made. Staying informed about these changes can help you make better investment decisions. Follow reliable news sources, join crypto communities, and consider subscribing to newsletters from industry experts.

Conclusion

So as you might have understood, DYOR should be your compass, guiding you through the hype and helping you make informed decisions. It's not always easy, and it's certainly not as exciting as buying a new trending coin. But it's the best way to protect your investment and increase your chances of success.

If you don't DYOR in crypto, you're essentially gambling. You might get lucky and make a profit, but you're just as likely to lose your investment. Not doing your own research leaves you vulnerable to scams. The crypto world is full of wolves in sheep's clothing, promising high returns with no risk. But as the old saying goes, if it sounds too good to be true, it probably is. So take your time, do your research, and don't be afraid to ask questions.